- Details

- Written by Ginna Schonwald

- Category: Articles

Representative Cassie Levesque of Barrington has worked hard to end child marriage in NH. As a result of her efforts, she has been successful in getting a bill passed in New Hampshire raising the minimum age that children can marry to 16 for both girls and boys (up from 13 years old for girls and 14 years old for boys). But it is not enough, Levesque says. Though the federal government set the marriage age at 18, most states allow children to marry at 16 or 17 and some allow children to marry as young as 12.

Representative Cassie Levesque of Barrington has worked hard to end child marriage in NH. As a result of her efforts, she has been successful in getting a bill passed in New Hampshire raising the minimum age that children can marry to 16 for both girls and boys (up from 13 years old for girls and 14 years old for boys). But it is not enough, Levesque says. Though the federal government set the marriage age at 18, most states allow children to marry at 16 or 17 and some allow children to marry as young as 12.

“We don’t allow children to do many things such as voting, driving, drinking, smoking because they do not have the legal capacity to understand the ramifications of such undertakings,” Levesque explains. “A 16 or 17-year-old doesn’t fully understand the medical complications of unsafe sex. They do not realize that maternal conditions and HIV/AIDS are some of the highest reasons for teen mortality so what we really need to do is to turn that question around and ask why would we continue to have a law that would allow children to become victims of these things.”

Research into child marriage started as a Girl Scout project for Levesque but soon became a passion. She knew about the devastating consequences of child marriage from her own family history. “My great-grandmother was 16 when she married my great-grandfather who was 49. It was during my research that I found out the effects of child marriage and then realized that my family has been dealing with these effects for at least two generations, if not more. We are talking about almost one hundred years of people affected by one marriage,” Levesque says.

Levesque refers to research by an organization called Unchained at Last, which shows many devastating consequences of child marriage, including serious health complications like HIV and other sexually transmitted diseases, poverty, and an early end to their education. This can leave child brides without the skills and resources to support themselves when a marriage ends in divorce, as between 70% and 80% of marriages before the age of 18 do.

A girl in the U.S. who marries young is 31% more likely to live in poverty when she is older, according to statistics gathered by Unchained at Last. The organization estimates that over 248,000 child marriages took place in the U.S. from 2000 to 2010. Of these, most were girls married to adult men.

Add to all of this that many girls and some boys are forced or coerced into child marriage by adults as a result of religious or cultural expectations. Often these marriages are to a much older partner who the child does not even know. Often the child is subjected to brutal physical and sexual abuse in the relationship. Though forced marriage is considered a human rights violation in the U.S., Unchained at Last notes that only 10 states have legislation that directly addresses forced marriage.

“Currently, I am working with Unchained At Last to establish a coalition to end child marriage in New Hampshire,” Levesque says. “I would encourage anyone who wants to join in advocating to end child marriage to write to our state officials and encourage them to learn more about child marriage and to vote to end it here in NH.”

- Details

- Written by Ginna Schonwald

- Category: Articles

Recently, Barrington residents received their December tax bills. Changes in property valuations along with changes in tax rates left some Barrington residents scratching their heads. “We printed a yellow flyer which was mailed along with the tax bill to help clear up confusion,” says Conner MacIver, Barrington’s Town Administrator. “It can be difficult enough to explain the tax rate. This year, with the property revaluation, it was a little more confusing for people.”

A property revaluation for the town of Barrington is required by state law every five years. The revaluation completed this year resulted in an average increase of 12% in Barrington property values. This brings Barrington properties in line with its current market value. As the value of town properties goes up, the tax rate per $1000 of value decreases. As a result of the revaluation, the tax rate for the town of Barrington dropped - from $24.78 per thousand dollars of assessed value to $22.67.

Some residents, active on the Barrington Connections Facebook page, have complained about tax rates increasing this year by 12% or more. According to Matt Towne, one of Barrington’s State Representatives, the revaluation hit some harder than others. “Unfortunately, starter homes, modular and mobile home values went up a lot so their taxes went up pretty dramatically,” Towne says, noting that these are the people who can least afford the higher taxes. “Then people get irritated and irate and take that out on the school or the library, which puts pressure on them to cut programs and salaries, which means higher turnover. It’s a vicious circle.”

Towne has talked to a lot of residents about an alternative: a broad-based tax that would help take the burden of school funding off those who can least afford it. “Funding schools with property taxes is a really outdated way of doing it. That’s why none of the other 49 states do it this way,” Towne points out. “We need to change the model.”

Towne supports a statewide income tax. He explains that he doesn’t want to see taxes increase, but instead to see the tax burden shift to those who are more able to pay. “When I canvassed last year, I’d say 30% of the people I talked to believed that we need a broad-based tax.” Towne is hopeful that a new governor will be elected in 2020 who will be willing to work for this change. He notes that one candidate, Andru Volinsky, has refused to take the pledge which has become an NH tradition - to not pass a state sales or income tax.

Residents can determine exactly how much taxes have increased for their own property by comparing their Fall 2018 and Fall 2019 tax bills. The bills include both the total property tax for the year and the assessed value of their property. Comparing the two bills allows residents to review their property value before and after the revaluation.

Barrington property owners who believe their property valuation is not accurate can apply to have their assessment reconsidered. An application is available online or at the Town Hall.

Below is one example which compares last year’s Barrington tax rates to this year’s, based on a property value of $250,000:

Fall 2018 Property Value = $250,000 x $24.78/thousand tax rate = $6195 total tax for 2018

Fall 2019 Property Value = $280,000 x 22.67/thousand tax rate = $6347 total tax for 2019

Total Tax Increase: 2.4% or $152.60

“The Select Board and Town Department heads have been working hard to control costs,” Town Administrator Conner MacIver notes. “This year, the town warrant articles had no additional tax impact.” This means that there was no increase in taxes from the town budget.

“The town portion of the tax rate has actually gone down in recent years. In 2014, 20% of the Barrington tax rate went to town services. Now the town portion – including the police department, fire department, town offices - is just 16%,” explains MacIver.

The school experienced a 1.98% increase in its budget, according to Barrington School District Superintendent Daniel Moulis. “If you look at the default budget, the increase would have been 1.27% for that,” Moulis notes that the school district has fixed costs that must be included in the budget each year. Examples of fixed costs include high school tuition, staff contracts that have been previously approved by voters, and transportation (bussing) costs.

Conner MacIver also notes that warrant articles passed in March doesn’t affect the tax rate until the fall billing. “There are several months between the time town residents vote for school and town budgets and the time that the changes are seen in tax bills,” MacIver says.

In addition to an increase in school costs, the County portion of the tax rate increased this year. The budget for the county is set by the Strafford County Commissioners, who are elected by voters. The Commissioners conduct public budget hearings as part of the process so that local residents can be informed about budget decisions at the county level.

Looking ahead to March 2020, what can voters expect? “We’re currently going through the budget process with the School Board and Advisory Budget Committee,” School Superintendent Moulis explains. “Our preliminary budget proposal includes a new preschool teacher and a new transportation contract.”

A warrant article for a new Barrington Public Library and Community Center will also be on the ballot this coming March. “They have been before the Select Board several times,” MacIver says, noting that the Select Board has been diligent in getting answers to citizen questions about the new building. “It will increase the tax rate for the entire term of the bond,” MacIver explains. “It’s important for voters to make those decisions.”

- Details

- Written by Kat Roedell

- Category: Articles

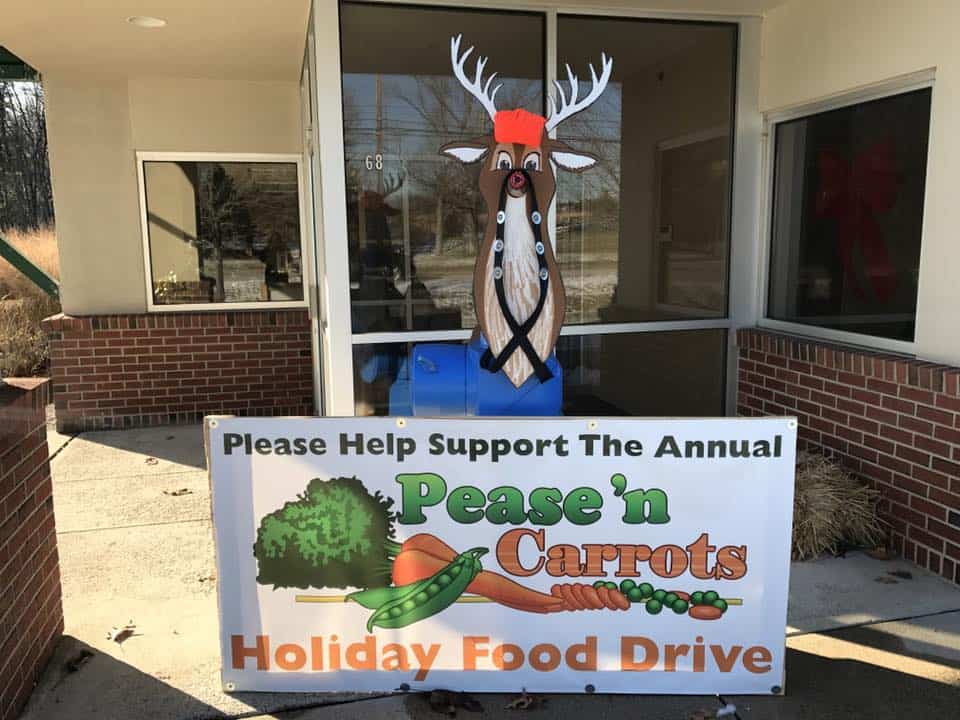

The 12th Annual Pease ‘n Carrots food drive has kicked off this year with some amazing goals to help feed the food insecure in the Seacoast area. For 2019, in partnership with Gather, the Pease ‘n Carrots team has a goal of 50 Pease Trade port Businesses participating, $50,000 in monetary donations, and 2,500 pounds of non-perishable food donated during the time frame of 11/18/2019 – 12/20/2019. The food and donations go directly to the food pantry – Gather, New Hampshire’s oldest charity is based in Portsmouth NH and is part of the Food Provider Network and, as such, gladly shares its bounty with 16 other area pantries.

Founded in 2007 by Mark Sullivan, of Seacoast Asset Management, the food drive has grown each year. In that year, Mark was a participant in the Leadership Seacoast program. While attending the courses, they took a tour of Cross Roads House homeless shelter in Portsmouth to learn what it would be like to be homeless and unemployed. Mark’s takeaway “There are a lot of invisible people in dire straits, right here in the Seacoast. They may be invisible intentionally, out of pride or because of the legal system, but they still need help. It was a need I didn’t know existed.” They may be out of sight but the less fortunate among us are everywhere and really need our help. “It was a population I didn’t even realize existed”.

Mark had previously started a softball league with others on the board of the Tenants Association at Pease Tradeport earlier and had noted that the situation there was different than most locales. The Tradeport is a world-class business park that is conveniently situated, remarkably well-kept and totally secure, and permeated by a real sense of camaraderie and an esprit de corps that may be unrivaled in our state.

Many of the businesses that participate in Pease ‘n Carrots bring that friendly competitiveness to the table. One such company donated pallets of green beans – because they weighed the most per can – and at the time the “My Cup Runneth Over” Trophy recognition was given for the most pounds of food donated. Now the rating system is based upon the most frequently recurring needs –but the friendly competition is still there.

The grand goals of the Pease ‘n Carrots food drive are three-pronged:

- No one should be hungry on the holidays – every person on the Seacoast, regardless of means, should have food throughout the holiday season, and beyond.

- To teach our children, and our children’s children how to give back joyfully – “It reminds you of how much you have when you give back” Mark Sullivan

- To get the entire community working together, to have every company on the Trade Port participating in this user-friendly initiative.

What You Can Do for this Food Drive: The Pease ‘n Carrots Food Drive is happening 11/18 through the Friday before Christmas: 12/20/2019. We are looking for non-perishable food donations or monetary donations. Make your check out to Gather, which will be using the monetary donations to fill in the gaps of the usual pantry items with fresh healthy foods. You can donate by patronizing one of the many fine Pease Tradeport restaurants including Grill 28, Green Bean, Paddy’s American Grille, Cisco Brewers (formerly Redhook), or Belle Peppers. You can make a monetary donation directly at This email address is being protected from spambots. You need JavaScript enabled to view it..

What you can do throughout the year: Non-perishable healthy food donations can be made at

Gather

210 West Road #3

Portsmouth, NH 03801

You can make a monetary donation directly to Gather on their website.

If You Need Help: Gather has an open pantry day on Fridays from 9am to 1pm, bring your photo id and proof. You can also apply for the program online, and if you have a food-based emergency you can come one time, no questions asked.

- Details

- Written by Patrick R. McElhiney

- Category: Articles

New Hampshire Local Area Unemployment Statistics Highlights – October 2019 Estimates (Note: Rates are not seasonally adjusted)

The October 2019 not seasonally adjusted State unemployment rate was 2.3 percent. This was unchanged from the September rate. The October 2018 rate was 2.0 percent.

New Hampshire’s October 2019 not seasonally adjusted labor force estimates show 11,850 more employed and 2,720 more unemployed than in October 2018 for a year-to-year net gain in the labor force of 14,570.

Fifteen areas recorded rates below the statewide not seasonally adjusted average of 2.3 percent:

- New Hampshire portion of the Lebanon NH-VT Micropolitan New England City and Town Area – 1.9 percent

- Plymouth NH Labor Market Area – 1.9 percent

- Concord NH Micropolitan New England City and Town Area – 2.0 percent

- New Hampshire portion of the Littleton NH-VT Labor Market Area – 2.0 percent

- Newport NH Labor Market Area – 2.0 percent

- Charlestown NH Labor Market Area – 2.1 percent

- New Hampshire portion of the Colebrook NH-VT Labor Market Area – 2.1 percent

- New Hampshire portion of the Conway NH-ME Labor Market Area – 2.1 percent

- New Hampshire portion of the Dover-Durham NH-ME Metropolitan New England City and Town Area – 2.1 percent

- Haverhill NH Labor Market Area – 2.1 percent

- Meredith NH Labor Market Area – 2.1 percent

- New London NH Labor Market Area – 2.1 percent

- Belmont NH Labor Market Area – 2.2 percent

- Manchester NH Metropolitan New England City and Town Area – 2.2 percent

- New Hampshire portion of the Portsmouth NH-ME Metropolitan New England City and Town Area – 2.2 percent

Eleven areas recorded rates at or above the statewide not seasonally adjusted average of 2.3 percent:

- Keene NH Micropolitan New England City and Town Area – 2.3 percent

- Peterborough NH Labor Market Area – 2.3 percent

- Raymond NH Labor Market Area – 2.3 percent

- Franklin NH Labor Market Area – 2.4 percent

- Hillsborough NH Labor Market Area – 2.4 percent

- Claremont, NH Micropolitan New England City and Town Area – 2.5 percent

- Laconia NH Micropolitan New England City and Town Area – 2.5 percent

- New Hampshire portion of the Nashua NH-MA New England City and Town Area Division – 2.5 percent

- Wolfeboro NH Labor Market Area – 2.5 percent

- New Hampshire portion of the Haverhill-Newburyport-Amesbury MA-NH New England City and Town Area Division – 2.7 percent

- Berlin NH Micropolitan New England City and Town Area – 2.9 percent

The New Hampshire portion of three interstate labor market areas contain only one town:

- New Hampshire portion of the Lowell-Billerica-Chelmsford MA-NH New England City and Town Area Division (Pelham town) – 2.9 percent

- New Hampshire portion of the Lawrence-Methuen-Salem MA-NH New England City and Town Area Division (Salem town) – 3.0 percent

- New Hampshire portion of the Brattleboro VT-NH Labor Market Area (Hinsdale town) – 3.1 percent

You can download the New Hampshire Local Area Unemployment Statistics for October 2019 source file.

Page 56 of 77